2/22/22 Trading Recap ($SPY, $AMZN, $TSLA)

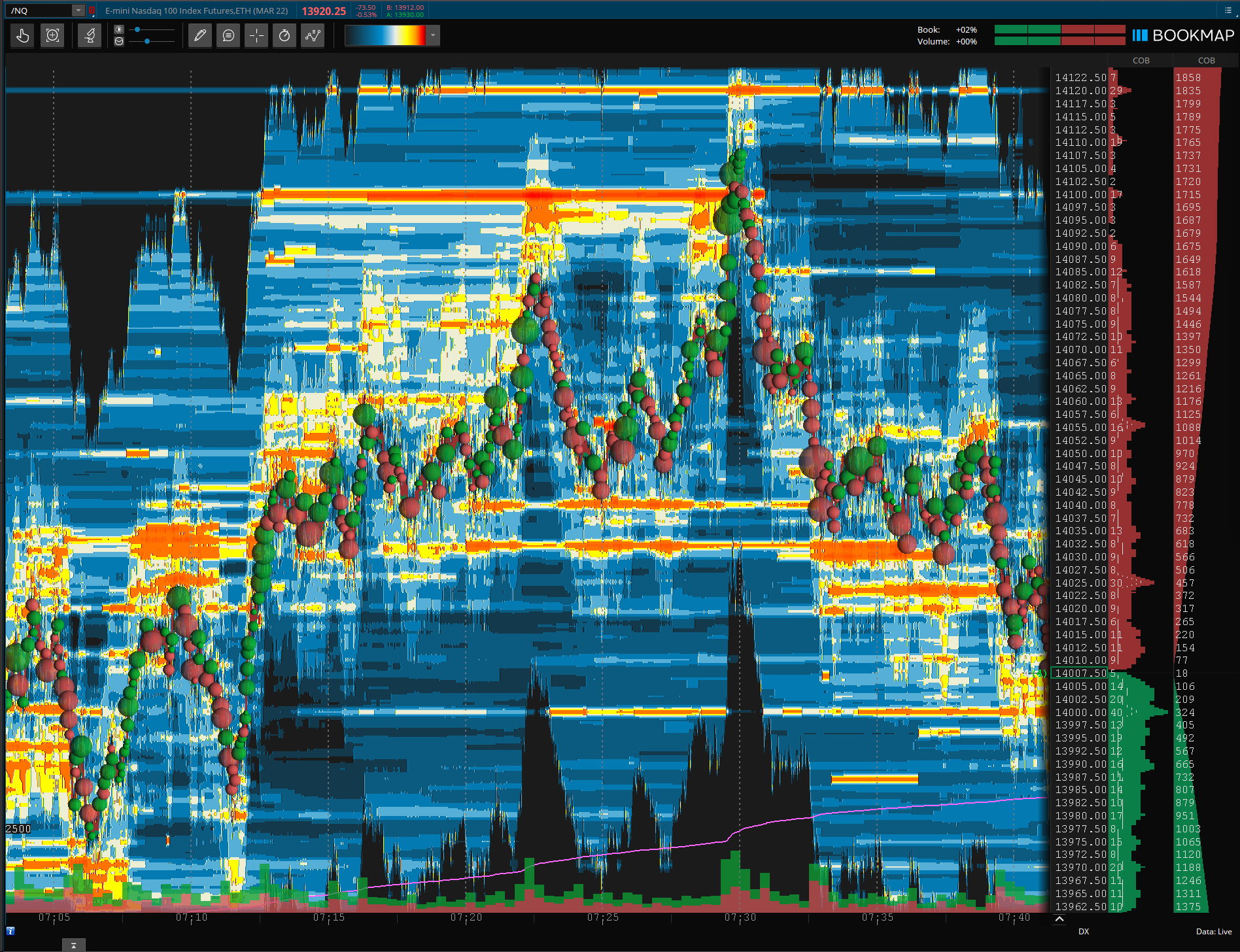

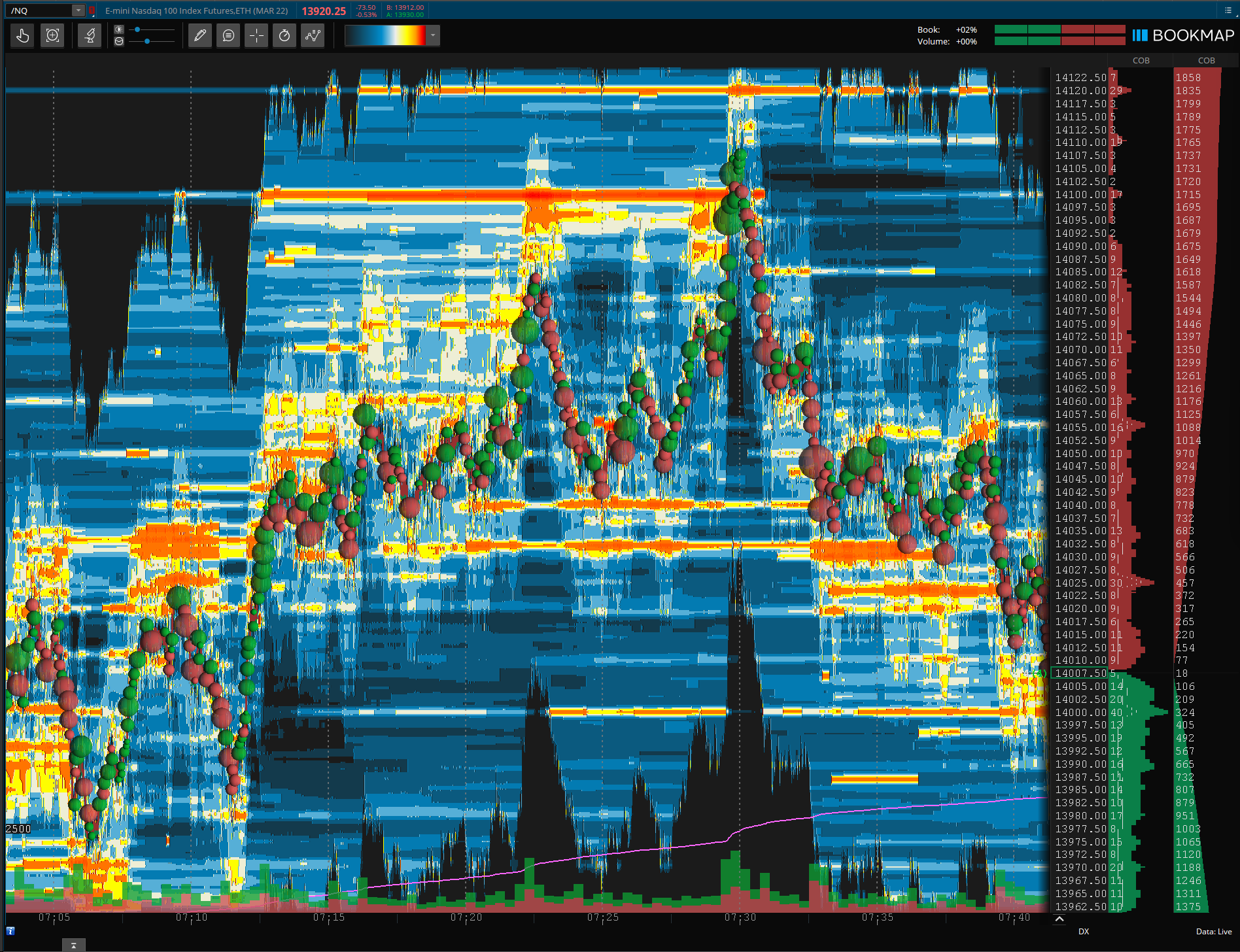

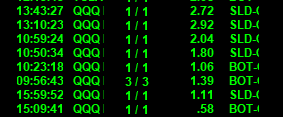

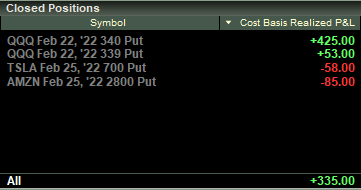

The market has been pretty weak to start 2022, along with some pretty volatile moves. Today I was leaning more towards the bearish bias because at one point the Nasdaq future was down about -3% and managed to recover before market open. It was on relatively low volume so I wasn’t ready to go long. As the Nasdaq approached the 14083 supply zone and began to reject, I got 3, 340p. I have been trying to follow my plan, as the price began to pullback and retest the zone I could have panic sold, but I noticed that the volume on the push was relatively low compared to the open. I was down by almost 40% at this point, before I would have panic sold, but knowing the market conditions and how weak the rallies I have been, I added one more contract for $1.04. Soon after it began to go straight down from here. My initial target was VWAP. As it came into the VWAP I locked in 2 contracts for a 100% gain. At this point my final two contracts were riding risk free. I was aiming for the January low around 13706, and it almost bounced perfectly off of this level. Although I was unable to sell at the bottom because I was not at the house, I had a stop loss in place to sell for around 150%, at $2.80.

I also took one more risky trade before the market closed. It was forming a lower high, I went short with a 399p that expired in 50 minutes. I was fully expecting to lose the entire value of this contract but at the high it was up almost 270%. I was able to secure yet again another 100% gain to finish off the day in the green.

There were also two trades on TSLA and AMZN that were uneventful. I tried to catch the downside moves on these two names but by this point they were very over extended and began to bounce. And AMZN didn’t have any follow through for the gap fill down.