Day Trading Recap 2/23

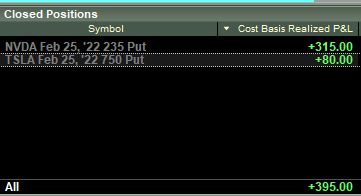

+$385

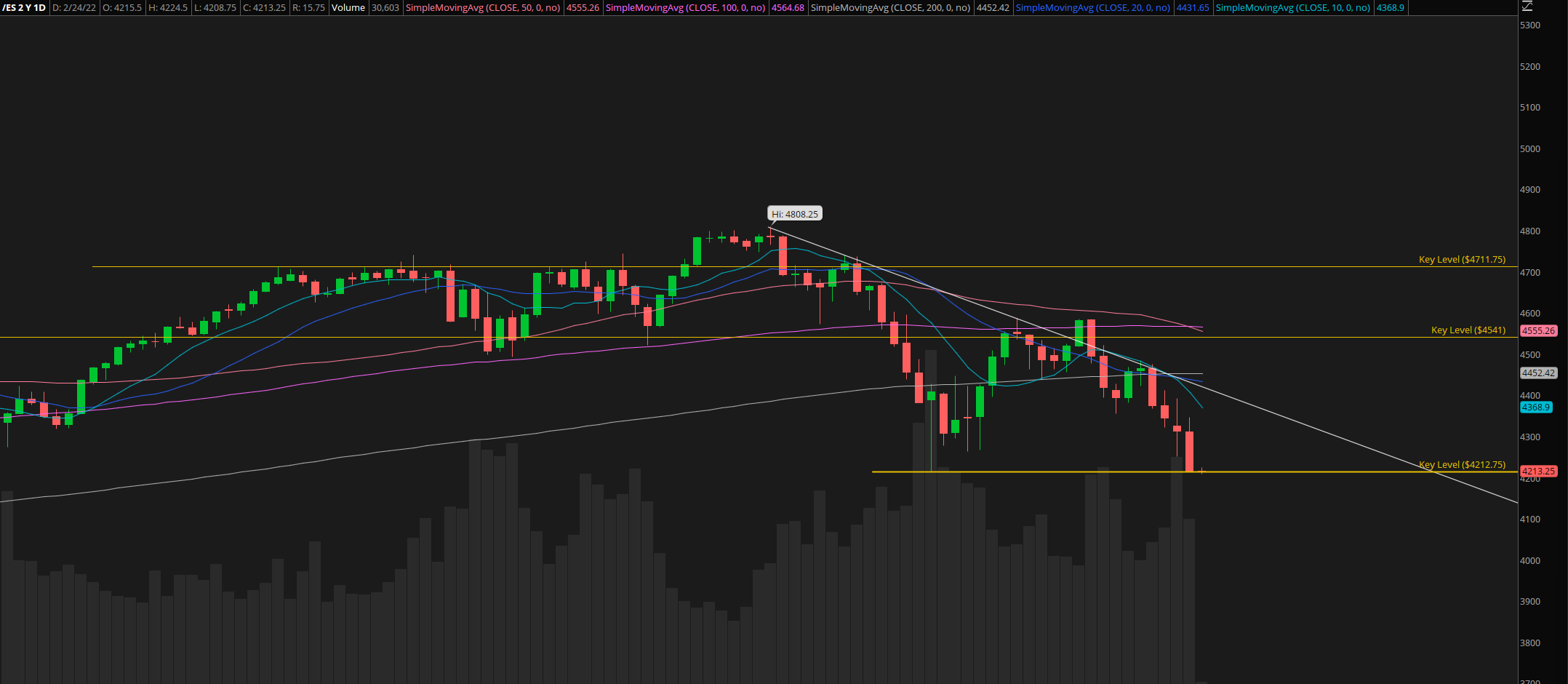

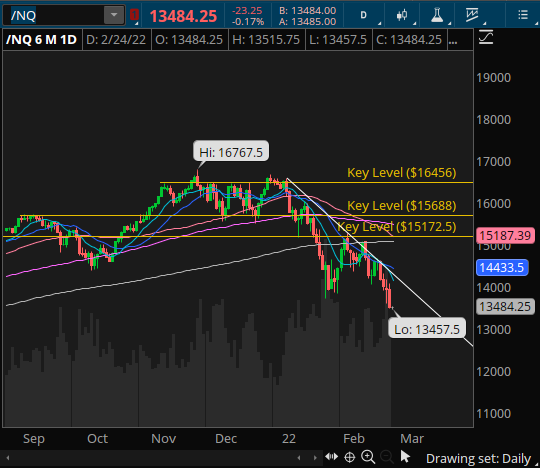

I have been leaning more towards a bearish bias, with all the news headlines and constant articles there haven’t been many reasons to look to go long. During the overnight session both the Nasdaq and S&P Futures rejected a previously marked supply zone. I was watching to see if it would retest it intraday, almost immediately off of the open it began to sell off. NVDA opened the day up in a supply zone I was watching, I took the opportunity to go short and got some 235p, my price target was $230, which was a key level. As price began to go in my favor I took 1 contract off to reduce my risk. Price came down towards $230 and looked like it could bounce so I exited my final contract for a 50% gain in total.

The stock I was watching was Tesla. It had a pretty big sell off as well to start the day. It formed a bear flag around $794 and flushed nicely. At first I got out for a small loss because it wasn’t moving as I liked but re entered as it began to show more weakness. Soon after, it broke $792 and began to sell off from there. I was able to make back my loss and more to end the day green $385.

I also took two small trades in my small account on TDA, I tried to scalp TSLA once again but wasn’t patient enough and my stop loss was way too tight, should’ve just left it alone for the day.