TESLA ($TSLA) Trade Recap 3/4

The past week has been a very good trading week for me. It took some adjusting to the recent market environments and really focusing on the mental aspects that were setting me back. I am only trying to focus on 3 particular stocks being AMZN, NVDA, TSLA. I also have been focusing on my entries and patience. When I see the indexes coming into supply and I am thinking about a long position I need to rethink and really think about the position I am about to take.

I also transferred more money into my primary trading account, now I will be able to take full advantage of trading TSLA. Previously I was using a “small” account and felt I was being reluctant to cut trades because I would be out of buying power for the day. Now if a trade starts to go against me, I am able to cut quickly and reposition myself. This also leads to other mental aspects such as not taking full advantage of the move and patient. Because I am able to cut and re enter quickly I will give up a good entry and chase the breakdown. Overall I am satisfied with my trading and where I am currently standing.

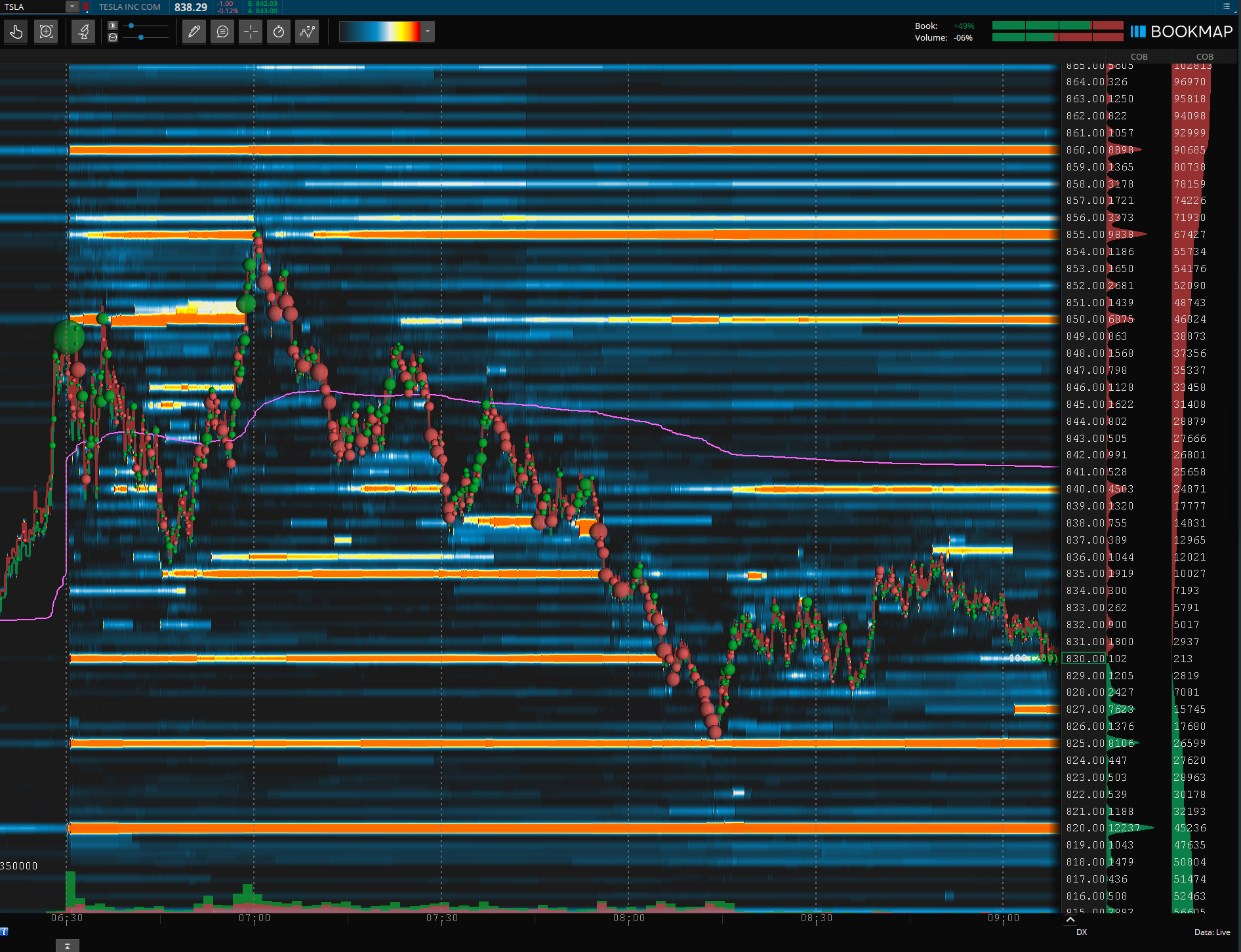

Today on TSLA, I was able to catch a great downside move. It was a very technical move and every level I had marked came to fruition. The $850 had acted like support multiple times in the past. Once again today it came up to test this level, got rejected and shot back down. I took a position in the 840p and almost got the bottom. I am really happy with the exit, I recognized the dragonfly doji candle, which signifies a reversal. And also the volume that came in signaled to me that it could be the start of a reversal, or “stopping volume” I was able to get out of the trade for a $500 gain or 80% on the contract. Also on bookmap there was a large wall of liquidity that could not be broken, which also coincided with the premarket low.