Trading Update, June 28th

Haven’t been able to take as many trades as I have wanted to recently. Moved money around and shifted money from brokers, which has taken a long to settle funds, different hours at work and working on trying to get my YouTube Channel setup. Most of the trades I have taken have been fairly small losses. I have reduced sized greatly and waiting for better opportunities to start scaling back up.

Today, on 6/28. I took a trade on NVDA. My plan was to catch the reversal off of $167, but it turned out to be a deadcat bounce and NVDA continued to sell off the rest of the day and closed around $160. I had all the levels to go short I was just more focused on catching the reversal instead of the downside move. Demand zones have been unreliable this year with the amount of selling pressure, I should be more focused on the break and retest rather than reversals in this market.

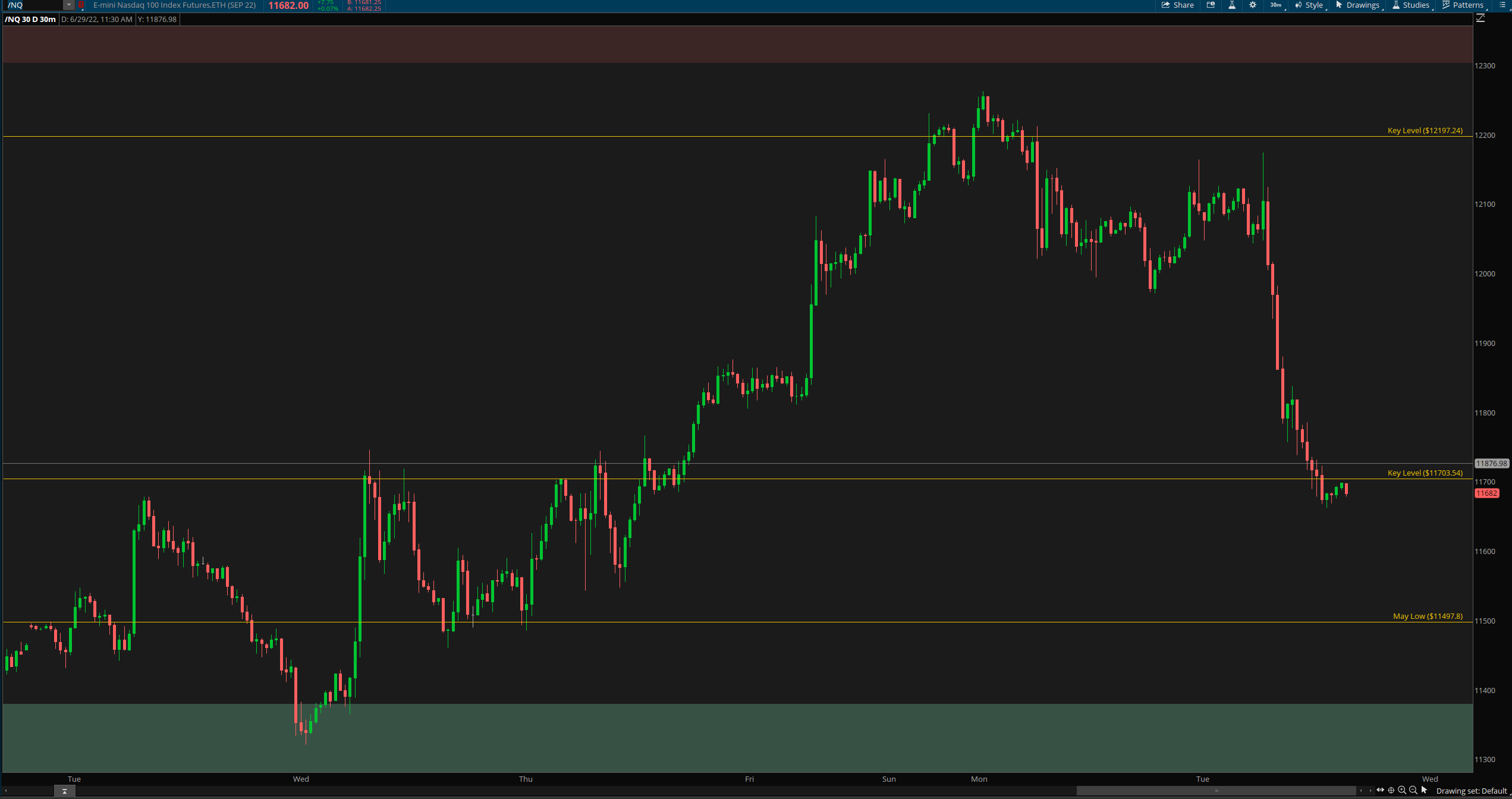

I knew the Nasdaq/S&P had room down lower after it broke their demand zones but once again for some reason hesitated on the downside move. Overall, not the worst trading day. I have been following my plan and strategy, just some hesitancy creeping in. Once I get all the funds settled and able to trade (and scalp) like I prefer to things will be much more easy to read.